Be Prepared

Remember this 2008 New York Times headline?

For Stocks, Worst Single-Day Drop in Two Decades

On September 29, 2008, less than seven years ago, the Dow Jones 30 Industrials (nowhere near the best index to use) suffered its biggest one-day drop in 20 years.

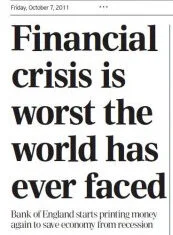

Less than two weeks later, London’s Daily Telegraph proclaimed that the financial crisis was “the worst the world has ever faced.”

Pretty scary stuff. If you hadn’t sold stocks yet, you were probably thinking about it.

By mid-October, Time magazine was running a Great Depressions era breadline picture on its cover with the caption, “The New Hard Times.”

The End of the World?

Almost universally, investors feared that we were witnessing the beginning of a new “Great Depression” and the panic out of stocks continued almost unabated. Many of those who previously believed they could ride out the market’s occasional declines were completely unnerved by a stock market falling more than most thought possible.

Through the rest of 2008 and into 2009, the financial markets looked grim, with no apparent end in sight. By February 16th, 2009, Time’s cover asked “How Can We Get Out of this Mess?”

Too Big to Fix?

The beginning of 2009 was almost universally fiscally gloomy. It was almost impossible to find anyone who felt good about investing in stocks.

Just three weeks later, amidst a climate of pervasive gloom – with the Standard & Poors 500 (S&P 500) at 683 – current current bull market quietly began with a few rising markets, followed by a few bad days. The news was still negative, so even the rapid increase from 683 to over 900 by early May went almost unnoticed, as investors expected that these higher prices were bound to fall back down, soon. From 2009 through 2014, the S&P 500 fitfully – with several 200-point declines – but inexorably climbed to 2,000 and beyond.

Did you brilliantly exit the stock market back in 2007 when the S&P 500 peaked above 1500? Then, did you force the better future that was to come and get back into stocks when the S&P 500 was nearing the bottom - below 700 – in March of 2009?

I can’t guarantee much, but I can guarantee that stock markets will plummet again some day and scare you to your core. I can also confidently state that, short of a planet-destroying event, they will eventually rise again.

I just don’t know when either will happen or the extent of the movement – no one can. The trick to being an equity investor lies in knowing that you have no more in stocks than your risk profile allows. It is critical to be sure you invest in a way that allows you to remain invested when the worst happens. For most that means a portfolio with far less than 100% invested in the global equity economy.