Financial Roadmap

Summer is not far away and many people are planning their annual vacations. In planning a trip it helps to know where you are starting from, what you’ll spend for the trip, and having some extra money to handle unexpected events along the way.

We All Do It

Investors are bombarded with information. Some of it is useful, most of it not so much. In the not so much category is most of the information provided by the financial media. In fact, this information is typically hazardous to your wealth.

Benefits of Bonds

Is it inevitable that interest rates are going up? Someday, it’s likely that they will but will rates rise in the next year or two? There is no way to know. Japan is recent example of what has happened to 10-year government bond rates over a fairly long period.

Risk vs. Uncertainty

One of the most important concepts that an investor needs to understand is the difference between risk and uncertainty. “Risk is present when future events occur with measurable probability. Uncertainty is present when the likelihood of future events is indefinite or incalculable.”

Nearsighted Investing

Myopia is a common condition for many people. If left untreated, this condition can be dangerous for the sufferer and others. Fortunately for those of us who have this condition, corrective lenses or laser surgery can remedy it. Myopic thinking, on the other hand, is common in humans and much more difficult to “cure”.

Any Hedge Edge?

How can U.S. investors reduce currency risk? By hedging the value of the international currencies against the dollar. The tools to do this are beyond the scope of this discussion but does currency hedging pay off for investors?

The Factor Difference

Today’s investors can take advantage of many advances in academic finance; including "factor" investing. Factor investing involves overweighting (relative to the overall stock market) small cap and value stocks. In 1992, Professors Eugene Fama and Kenneth French documented the historical return premiums (over the market return premium) of small cap and value stocks.

Investing Factors

Investing has evolved over the last fifty years. In the past, if you wanted to invest in the stock market you headed down to your local Merrill Lynch office and bought individual stocks through a broker.

Backdoor Roth

Roth IRAs are a great tool for building retirement assets, especially if you start contributing to them when you are young. Contributions to a Roth are not tax deductible, unlike traditional IRAs. The benefit of a Roth is that your money grows tax-free.

Don’t Be Shark Bait

The popular TV show Shark Tank pits budding entrepreneurs against a group of successful entrepreneurs (the sharks). The goal of the budding entrepreneurs is to convince one or more of the sharks to buy a part of their business in order to raise capital for their business. Is there a real world equivalent of Shark Tank?

Holistic Income

Today’s interest rates are low. For those of us reaching retirement, when we will be taking money from our portfolios to live on, we are often very concerned with the level of interest rates. We want to preserve our principal and live off of the dividends and interest. What do we do in an environment like this?

Why Bonds?

Why do people focus on what the future holds for bonds? In many cases, it is because they don’t look at the assets in their portfolios as parts of a whole. They obsess over each asset in their portfolio without consideration of how each asset in a well-constructed and well-diversified portfolio compliments the other assets in their portfolio.

Sport of Stock Betting

Sports betting and securities speculating are zero-sum games. For every winner, there must be a loser (someone who guesses right on new information and someone who guesses wrong on new information).

Social Security Annuity

About 40% of men and 45% of women claim Social Security at the earliest possible age, 62 years old. In doing so, they can shortchange themselves, in terms of lifetime benefits, by a considerable amount.

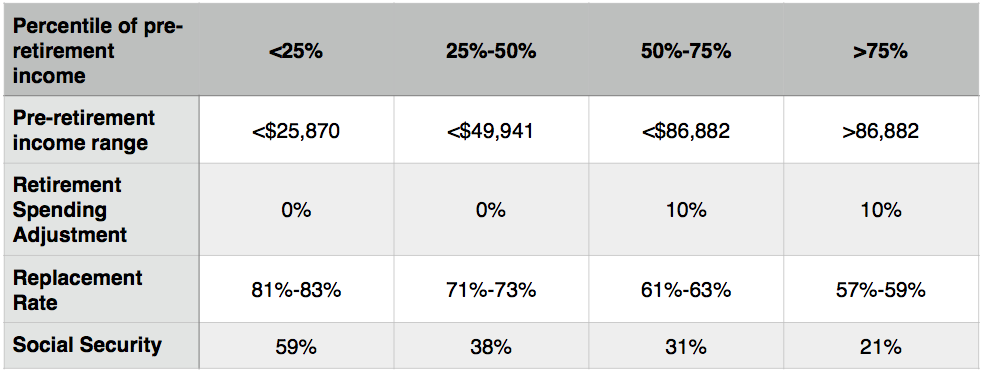

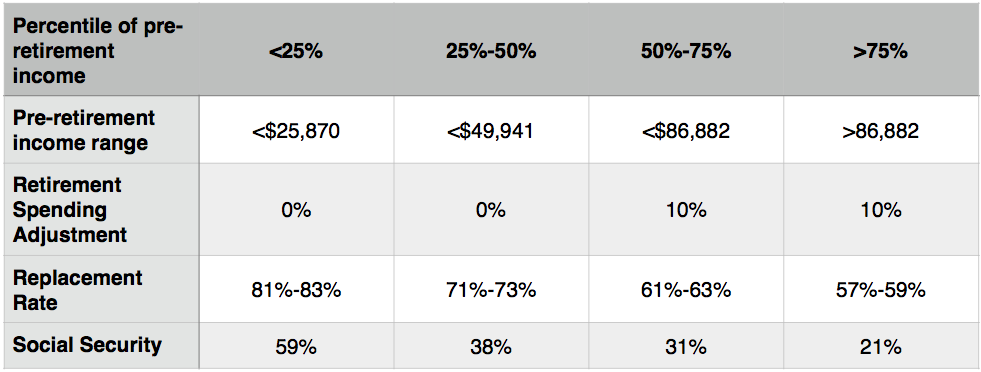

How Much You Need II

For most of us, retirement won’t resemble our father’s (or more likely grandfather’s) retirement. The responsibility for funding our retirement has shifted from the employer to the employee.

How Much You Need

When it comes to retirement lifestyle, most people we talk with want to maintain their current lifestyle, with perhaps some other pleasures, like travel, thrown in. They want to have the lifestyle that they’ve grown accustomed to over the decades.

Know the Knowable

With all of the market uncertainty, isn’t there someone who can see the future and get us out of investments before they go down (in this case stocks) and put our investments in something safe? Why can’t the experts “get it right” and protect us from market fluctuations?

The Question: To Save or Not to Save

An often stated regret is, “I wish I would have started saving and investing when I was young, just think what I’d have saved now for retirement!” Time is on our side when we’re young, not so much as we near retirement.

DIY vs. DIWH (with help)

Investors have to decide how they will invest their money and who will help them do it. Most investors choose the do-it-yourself (DIY) route. Others choose to hire a professional financial advisor to develop a well-thought-out financial plan and invest in alignment with that plan.

Two-Fund Solution

The amateur tennis player’s winning strategy should be getting the ball over the net and let his opponent make a mistake. Similarly, investing should be a game of earning market returns and letting someone else make the mistake of timing the market. How can a do-it-yourself invest accomplish this?