Mind vs. Money

Despite everything we know about efficient capital markets and all the solid evidence available to guide our rational decisions … we’re still human. We’ve got things going on in our heads that have nothing to do with solid evidence and rational decisions – a brew of chemically generated instincts and emotions that spur us to leap long before we have time to look.

Laboring for the Future

In the wake of Labor Day, you should consider whether your hard-earned money is doing the most for your future. With pensions almost extinct, how can you make your 401k work harder for a better retirement?

Over the Hedge

A recent press article said that with major risk assets looking "fully valued," it was time to seek out alternative investments such as hedge funds. But those thinking of making that shift might want to look before they leap.

Gold Glitters - Doesn't Grow

It almost seems like “conventional” wisdom; you should have a portion (typically 5%) of your portfolio in gold. The reasons for owning gold vary, but they tend to be highly emotional as opposed to rational.

Chasing Performance

It’s human nature to believe that we can get an edge on someone else. We haggle with the car seller to get a “steal of a deal.” We spend hours figuring out our fantasy football rosters-who to draft, who to play, in hopes of winning our league. Nowhere is this tendency more prevalent than in our investing behavior.

Latest Real Investing Research

In our last piece in this series, “The Weight of Evidence,” we introduced three key stock market factors (equity, value and small-cap) plus a couple more for bonds (term and credit) that have formed a backbone for evidence-based portfolio construction. Continued inquiry has found additional market factors at play, with additional potential premiums.

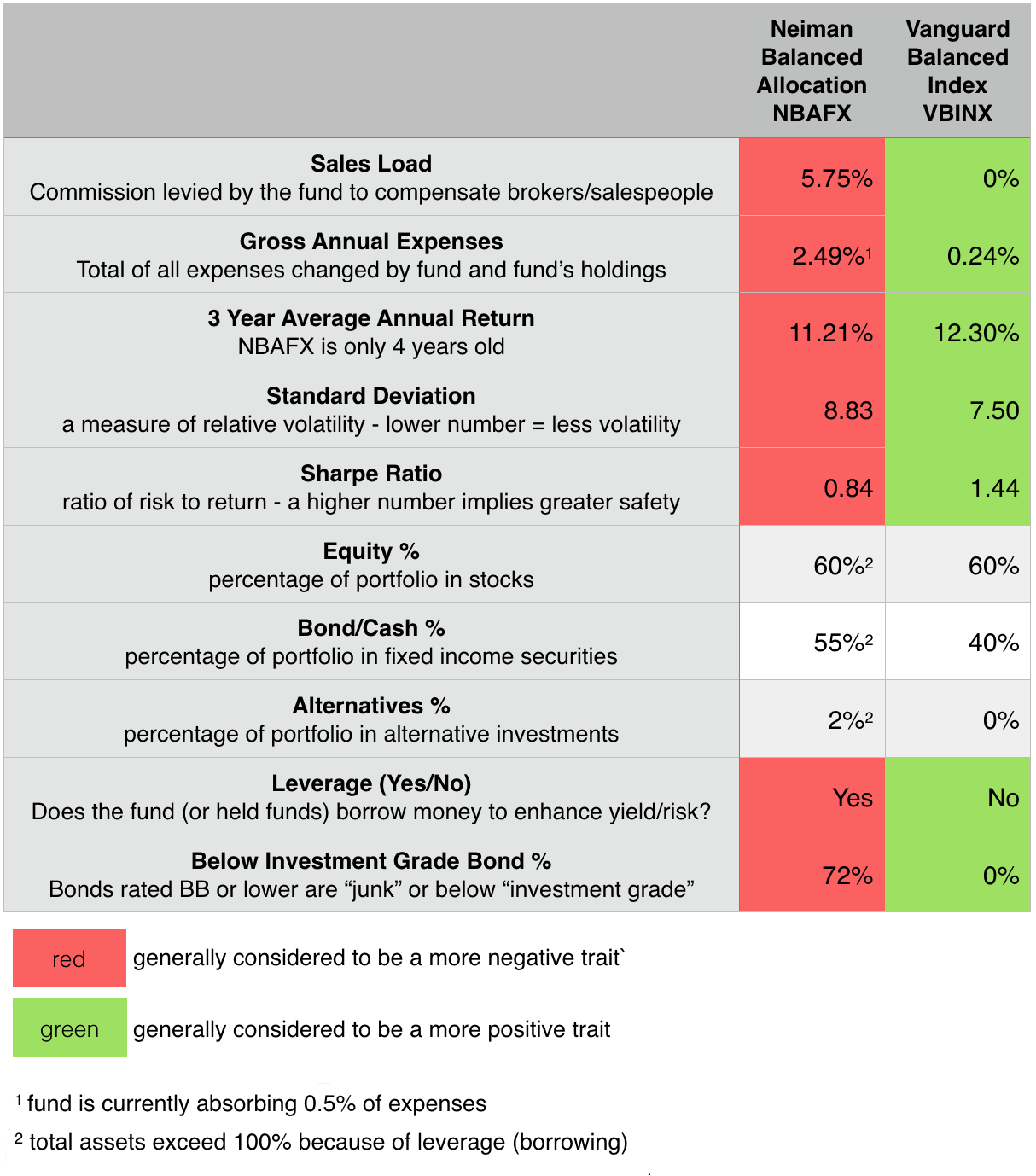

Fund of Funds of Fees

Since higher fees have been shown to be detrimental to shareholders’ returns, you would think that an executive of an expensive fund would be reticent to talk with someone who tells his publicist “I plan to ask some tough questions about the funds’ portfolio and expense ratios and whether or not these meet the firm's fiduciary responsibilities to its clients.”

Are There Good Fees?

You’ve probably heard us whistle this tune so often that you can sing along yourself: Among the best ways to maximize expected returns is to minimize the costs involved in achieving them. This begs the question: What about those fees you pay to folks like us? Do we earn our keep?

Avoiding Money Traps

“You don’t need to be an expert in order to achieve satisfactory investment returns. But if you aren’t, you must recognize your limitations and follow a course certain to work reasonably well. Keep things simple and don’t swing for the fences.

Fiduciary Follies

The battle over requiring all financial advisors to act as fiduciaries rages on with both the Department of Labor and the SEC considering fiduciary rules. Probably the biggest reason that nothing has actually happened since the Dodd-Frank mandated considering of a universal fiduciary standard in 2010 is the aggressive resistance of the brokerage and insurance industries.

The Weight of Evidence

An accumulation of studies dating back to the 1950s through today has identified three stock market factors that have formed the backbone for evidence-based portfolio construction over the long-run.

Unbearable Market Rx

If it weren’t for the fact that it represents real wealth, it would be nothing short of fascinating how the market reflects its human participants – in all of our enterprising glory as well as all of our quirky behavioral foibles, including herd mentality.

Money & Shower

What is the single most important aspect of a typical human’s life? Basic survival? Pleasure? Enlightenment? Care? I suggest that it is money.

Your Investing Business

“Investment is most intelligent when it is most businesslike”

-From the “Intelligent Investor” by Benjamin Graham.

Seeking Real Investing Info

There’s real investing information, and there’s “investing” information. “Investing” information (with quotes) is the stuff that much of Wall Street, Big Insurance, and far too much of the mass money media provides to millions of people who need real investment knowledge, but don’t know where to look.

Invest with Evidence

Grounding your investing strategy in rational methodology helps you best determine and stay on a course toward the financial goals you have in mind, especially when your emotional reactions threaten to take over the wheel.

How Much Do You Need? 2

If you’re unable to imagine your exact retirement lifestyle, is planning for it futile? Two research papers answer that question with an emphatic “no.” Planning and saving for retirement are vitally important.

Bad Advice Detection

Following the Main Money Media will typically leave you more confused than enlightened. Responding to the amped-up assertions of most weekend or late night money show hosts can be downright dangerous. Add the sheer volume of financial information available today and distinguishing valuable investing information from all the bad advice bandied about can be overwhelming.

How Much Do You Need?

During their working lives most people are faced with the following question, “How much should I save for retirement?”. This is a great question but before you can answer that question, several other questions deserve to be asked.

Fiscal Tease

USA Today stock market reporter Matt Krantz must be desperate for topics. I can’t remember the last time I read a story with as tantalizing a title followed by as much ridiculous “investment” rubbish.