Planning for Stormy Seas

Embarking on a financial plan is like sailing around the world. The voyage won’t always go to plan, and there’ll be rough seas. But the odds of reaching your destination increase greatly if you are prepared, flexible, patient, and well-advised.

Ignore "History on the Run"

When news breaks and markets move, content-starved media often invite talking heads to muse on the repercussions. Knowing the difference between this speculative opinion and actual facts can help investors stay disciplined during purported “crises.”

News We Don't Need

One academic study appears to confirm the view that the apparent preponderance of bad news is as much due to demand as to supply, with participants more likely to select negative content regardless of their stated preferences for upbeat news.

Banish Bad Behavior

Have you ever made yourself suffer through a bad movie because, having paid for the ticket, you felt you had to get your money’s worth? Some people treat investment the same way.

The Patience Principle

Global markets are providing investors a rough ride at the moment, as the focus turns to China’s economic outlook. But while falling markets can be worrisome, maintaining a longer term perspective makes the volatility easier to handle.

Grecian Concern?

In recent weeks, the world’s markets and media financial pages have focused intensely on the standoff between debt-laden Greece and its international lenders over the conditions of any further bailout. Is this Grecian financial crisis a cause for serious concern?

Rough Road Investing

Owners of all-purpose motor vehicles often appreciate their cars most when they leave smooth city freeways for rough gravel country roads. In investments, highly diversified portfolios can provide similar reassurance.

Seven Roles of an Advisor

What is a financial advisor for? One view is that advisors have unique insights into market direction that give their clients an advantage. But of the many roles a professional advisor should play, soothsayer is not one of them.

Melt Down Under

The media occasionally locks in on a particular “hot” sector. In the late 1990s, it was technology. In the mid-2000s, it was mining. Writing headlines about fashionable sectors is one thing. Building investment strategies around them is another.

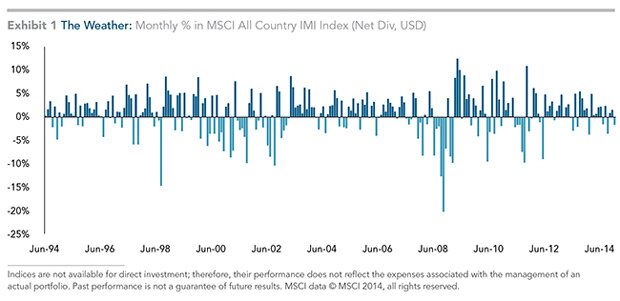

Weather vs. Climate

Notice how TV news bulletins put finance next to the weather report? In each, talking heads point at charts and intone about intraday events that are quickly forgotten. Meanwhile, the long-term wealth building story gets overlooked.

Googlevesting?

What can’t Google do? Free email, customized searches, maps, apps, browsers, video—the list goes on. Now researchers claim to have found a link between Google searches and future stock market movements.

Bouncing is Back

Volatility has returned. Just as many people were starting to think markets only ever move in one direction, the pendulum has swung the other way. Anxiety is a completely natural response to these events. Acting on those emotions, though, can end up doing us more harm than good.

Bonds: Managing. Not Predicting.

There's a school of thought that says the best way to manage a fixed income portfolio is to base your investment decisions on where you think interest rates are headed. But what if expectations are changing all the time?

Over the Hedge

A recent press article said that with major risk assets looking "fully valued," it was time to seek out alternative investments such as hedge funds. But those thinking of making that shift might want to look before they leap.

Your Portfolio's Future

Much financial news purports to be about the future but is really just an account of the past. As a result, many investors project what has already happened onto an imagined future. It’s understandable that investors, with the help of a necessarily short-term-focused media, will tend to focus most of their attention on what has happened in financial markets in the past month, week, day, or even hour.

Uncertainty is Certain

A frequent complaint from would-be investors is that “uncertainty” is what keeps them out of the financial markets. “I’ll stay in cash until the direction becomes clearer,” they will say. So when has there ever been total clarity?

Golden Ticket Trap

In a popular children’s story, the young hero pins all his hopes on finding one of a handful of “golden tickets” hidden among millions of candy bars. It seems many people approach investing the same way.

Control Yourself

Working with markets, understanding risk and return, diversifying and portfolio structure—we've heard the lessons of sound investing over and over. But so often the most important factor between success and failure is ourselves.