Where Did My Premium Go?

From 1928–2017 the value premium in the US had a positive annualized return of approximately 3.5%. In seven of the last 10 calendar years, however, the value premium in the US has been negative. So, what happened to it?

The Reality of Average

The US stock market has delivered an average annual return of around 10% since 1926. But short-term results may vary, and in any given period stock returns can be positive, negative, or flat.

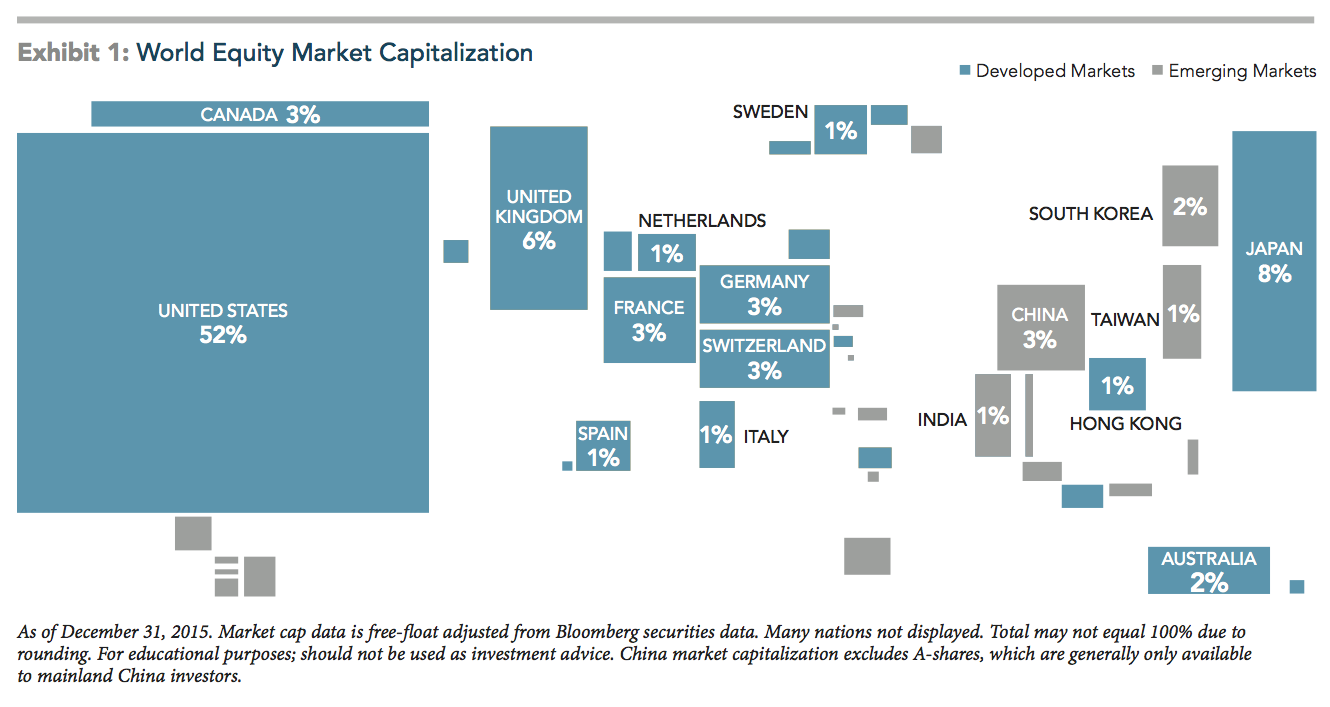

Own the Whole Planet

By pursuing a globally diversified approach to investing, one doesn’t have to attempt to pick winners to achieve a rewarding investment experience.

So What Happened Last Year?

At the beginning of 2017, a common view among money managers and analysts was that the financial markets would not repeat their strong returns from 2016. Many cited the uncertain global economy, political turmoil in the US, implementation of Brexit, conflicts in the Middle East, North Korea’s weapons buildup, and other factors. The global equity markets defied their predictions, with major equity indices in the US, developed ex-US, and emerging markets posting strong returns for the year.

Not Getting What You Pay For

People rely on a lot of different information about costs to help inform these decisions. When you buy a car, for example, the sticker price tells you approximately how much you can expect to pay for the car itself. But the sticker price is only one part of the overall cost of owning a car. Other things like sales tax, the cost of insurance, expected routine maintenance costs, and the potential cost of unexpected repairs are also important to understand.

Don't Fear The Market

It's been just over 10 years since, in early October 2007, the S&P 500 Index hit what was its highest point before losing more than half its value. There are important lessons that investors might be well-served to remember to better prepare for the next crisis and its aftermath.

Stop Monkeying With Your Money

In the world of investment management there is an oft-discussed idea that blindfolded monkeys throwing darts at pages of stock listings can select portfolios that will do just as well, if not better, than both the market and the average portfolio constructed by professional money managers. If this is true, why might it be the case?

How the Markets Work for You

Upon observing a pencil, it is tempting to think a single individual could easily make one. After all, it is made up of common items such as wood, paint, graphite, metal, and a rubber eraser. By delving deeper into how these seemingly ordinary components are produced, however, we begin to understand the extraordinary backstory of their synthesis.

The Downside of Plain Indexing

Index funds are an innovative solution for investors that provide diversified investments at low fees. On any given day, an investor can observe the performance of indices from providers such as MSCI, S&P, or Russell —and that means it’s easy to monitor whether or not an index fund manager replicated the index’s performance (gross of fees and expenses). However, an index fund manager’s strict adherence to an index comes at a cost in the form of reduced discretion around trading.

The Fed and Expected Returns

In liquid and competitive markets, current interest rates represent the expected probability of all foreseeable actions by the Fed and other market forces.

On Elections and Equities

Next month, Americans will head to the polls to elect the next president of the United States. While the outcome is unknown, one thing is for certain: There will be a steady stream of opinions from pundits and prognosticators about how the election will impact the stock market

DFA on Brexit

Dimensional Fund Advisor's global market experience is unmatched in the money management business so their perspective of the Brexit referendum and its potential economic impact deserves attention.

Erasing Bad Results

One of the tricks used by the actively managed mutual fund industry is to close down a poorly performing or merge it into a better fund, thus erasing that fund's performance from the group's performance history. This results in misleading results and claims about the manager's past through what is called "survivor bias."

Why Diversify?

Equity markets have experienced a sharp decline to start 2016, leading some investors to reevaluate their asset allocation. As US stocks have outperformed developed international and emerging markets stocks over the last few years, some investors might consider reevaluating the benefits of investing outside the US.

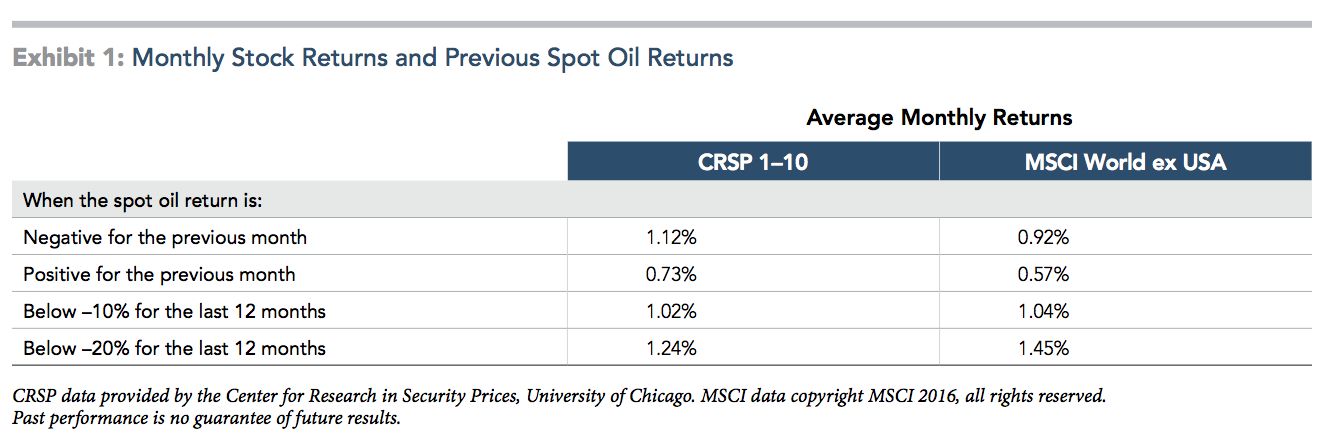

Oil & Markets

In the past there has been little correlation between oil prices and the value US stocks, Lately, stocks and oil prices have been moving in a more similar fashion. Is it likely that oil and stock prices will correlate more closely in the future? The analysts at Dimensional Funds explore the possibilities.

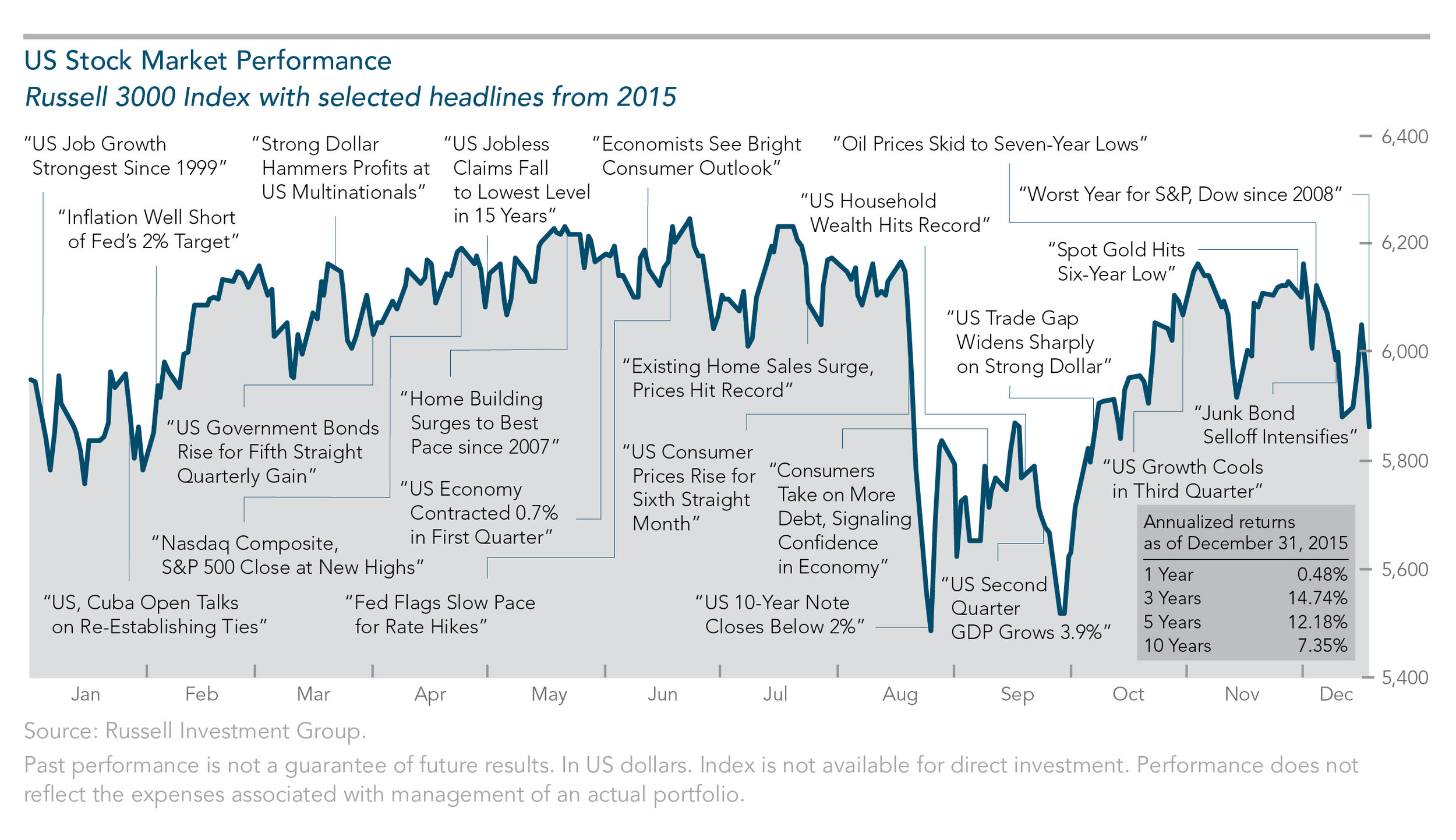

Review of 2015

The US economy and broad market showed modest gains during the year, although investor discipline was tested by news of a global economic slowdown, rising market volatility in China and emerging markets, falling oil and commodities prices, and higher US interest rates.

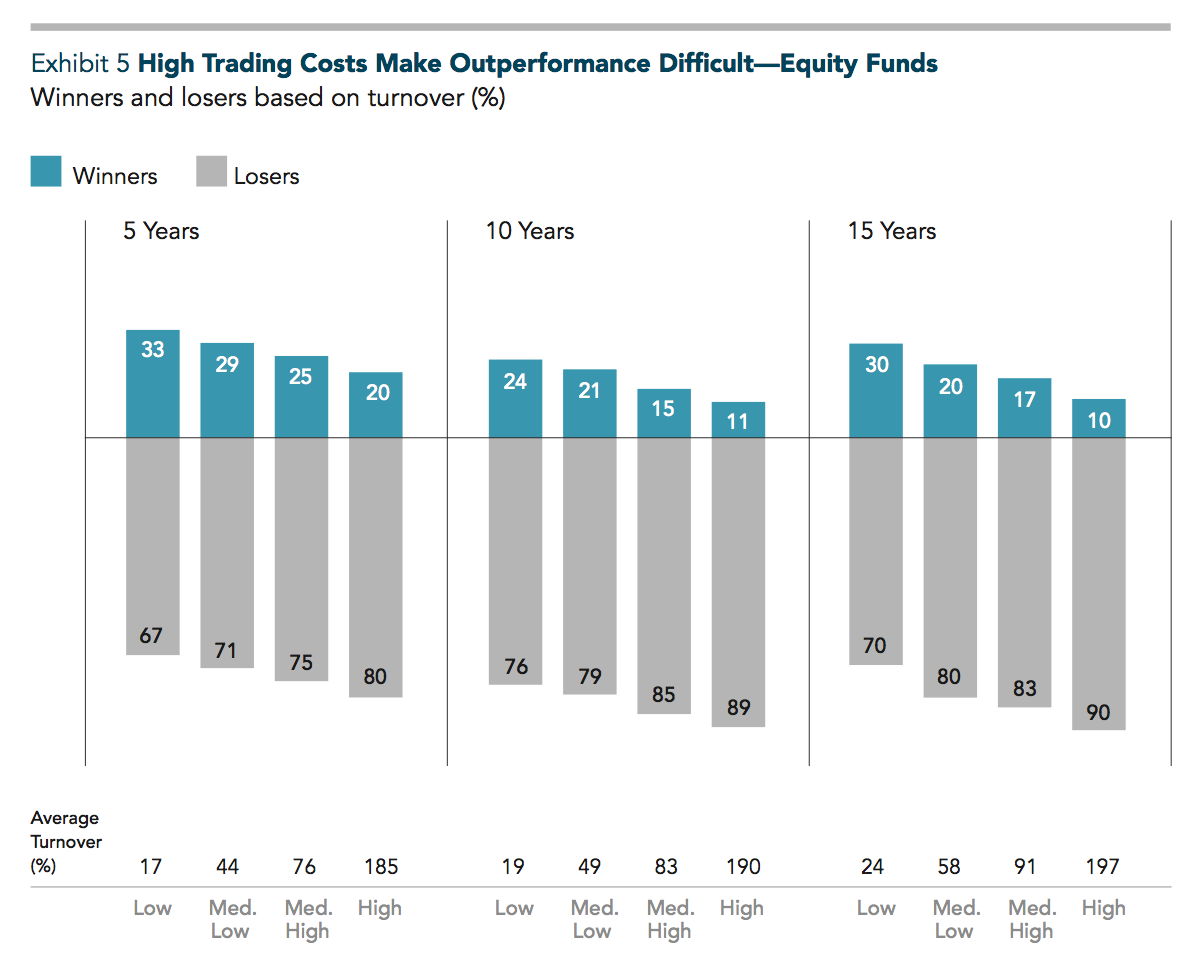

The Mutual Fund Landscape - Conclusion

There are other activities can add substantially to a mutual fund’s overall cost burden. Equity trading costs, such as brokerage fees, bid-ask spreads,1 and price impact, can be just as large as a fund’s expense ratio. Trading costs are difficult to observe and measure, but they impact a fund’s return nonetheless—and the higher these costs, the higher the outperformance hurdle.

The Mutual Fund Landscape - Part Three

If competition drives prices to fair value, one might wonder why underperformance is so common. A major factor is mutual fund costs. Costs reduce an investor’s net return and represent a hurdle for a fund. To outperform, a fund must add enough value to exceed its costs.

The Mutual Fund Landscape - Part Two

The competitive landscape makes the search for future winners a formidable challenge. Confronted with so many fund choices, some investors may resort to using track records as a guide to selecting funds, reasoning that a manager’s past outperformance is likely to continue in the future.

The Mutual Fund Landscape - Part One

The U.S. mutual fund industry comprises a large universe of markets around the world. These funds reflect different philosophies and approaches. In this multi-part series, find out the industry has performed and what you should think about when selecting funds.