Q&A: Another Stock?

I am interested in investing in individual stocks for the long term - do you still give this advice? Years ago (20+ yrs) I will never forget the advice you gave on the 'old' Don McDonald Show...

What's It Really Worth?

The headline read “What is Gold REALLY Worth? After reading the article, I still didn’t know. Probably because it’s a question without an absolute answer. What is anything REALLY worth?

Googlevesting?

What can’t Google do? Free email, customized searches, maps, apps, browsers, video—the list goes on. Now researchers claim to have found a link between Google searches and future stock market movements.

Social Security Annuity

About 40% of men and 45% of women claim Social Security at the earliest possible age, 62 years old. In doing so, they can shortchange themselves, in terms of lifetime benefits, by a considerable amount.

Main Street Broker

While researching another piece, I stumbled across a 2012 in-depth article about one of my least favorite financial firms, Edward Jones. I believe that, because of its incredible reach, no brokerage firm has done more damage to more people than Ed Jones...

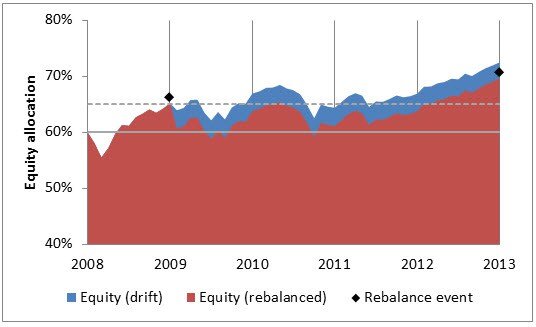

Tough to Balance

As much as we love to see our portfolios grow over time, we must occasionally face our own fear: rebalaphobia, or the fear of rebalancing.

Video: How Much to Save for Retirement

How much should you be saving for retirement? Massi De Santis, PhD, explains that the answer should be customized for each individual, based on how their income grows prior to retirement.

Bouncing is Back

Volatility has returned. Just as many people were starting to think markets only ever move in one direction, the pendulum has swung the other way. Anxiety is a completely natural response to these events. Acting on those emotions, though, can end up doing us more harm than good.

Q&A: When to Move?

My son, a govt. worker, is locked into the gov. investment plan and finds it difficult to know when to move between funds in this environment. Any clues?

Take Your Lump?

Will Halloween bring former Boeing employees a trick or a treat. That’s the last day for many ex-workers to decide between trading in their Boeing pension for a lifetime monthly payment or a lump-sum payment.

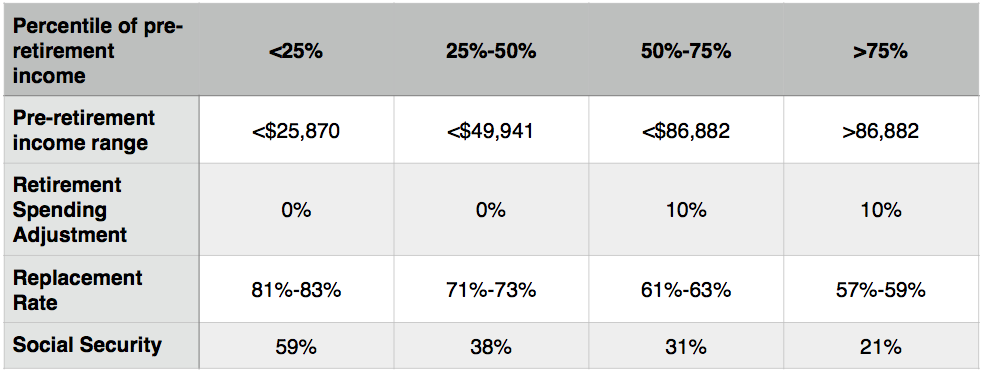

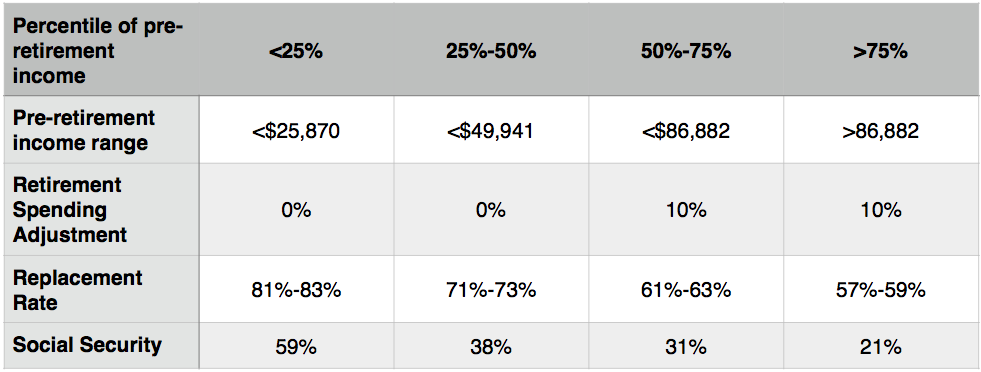

How Much You Need II

For most of us, retirement won’t resemble our father’s (or more likely grandfather’s) retirement. The responsibility for funding our retirement has shifted from the employer to the employee.

Q&A: Keep Oppenheimer?

My father recently passed and left an inherited IRA to myself and 4 siblings. It is currently in the Oppeheimer Fund OMSOX. Would you recommend staying in this fund? If not, what would you advise?

How Much You Need

When it comes to retirement lifestyle, most people we talk with want to maintain their current lifestyle, with perhaps some other pleasures, like travel, thrown in. They want to have the lifestyle that they’ve grown accustomed to over the decades.

How Low Can They Go?

Some day bond yields will go up. When? No one knows. How far? Your guess is as good as anyone's. Lots of expert prediuctions have been made over the past few years and most of them have been dead wrong.

Nothing Really Happened

Stock market declines are painful when they impact the near-term value of your investment portfolio. It really hurts. But rather than reacting to bad market news, try to harness it to the higher purpose of achieving your personal financial goals

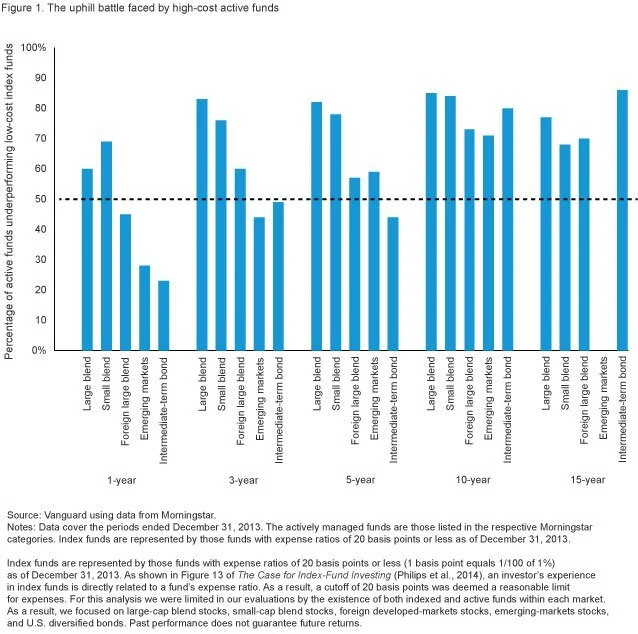

Active Myth Busted

After all costs are considered (spreads, market impact, management fees, taxes, etc.), the net return of all transactions must underperform the market benchmark. This is one of the few mathematical certainties in investing.

Q&A: Seeking Diversification

Can you recommend a mutual fund that has about 80% muni-bonds and 20% total-stock-market or similar equity? I'm a Vanguard (and index) fan, but they don't have anything that fits those parameters. Obviously, I want it to be tax efficient.

Know the Knowable

With all of the market uncertainty, isn’t there someone who can see the future and get us out of investments before they go down (in this case stocks) and put our investments in something safe? Why can’t the experts “get it right” and protect us from market fluctuations?

Bad Alternatives

The latest hot investment fad are these things called "alternative funds." "Fad" rhymes with "bad." However, investing fads have a great deal more incommon with the word "bad" than just those last two letters. In most cases they are defined by the word.

Finding an Advisor

Make sure you know your advisor before entering into this critical business relationship. One of the most critical questions to ask: “Are you required to act as a fiduciary?”