Don’t Be Shark Bait

The popular TV show Shark Tank pits budding entrepreneurs against a group of successful entrepreneurs (the sharks). The goal of the budding entrepreneurs is to convince one or more of the sharks to buy a part of their business in order to raise capital for their business. Is there a real world equivalent of Shark Tank?

Lucky You're Smart

Most of us believe we know more than we can possibly know. Are you of above average intelligence? Of course, you are. Are you a better driver than most? Yeah, but these other bleeping idiots on the road aren’t. So, if you're so smart why do keep confusing luck with skill?

Holistic Income

Today’s interest rates are low. For those of us reaching retirement, when we will be taking money from our portfolios to live on, we are often very concerned with the level of interest rates. We want to preserve our principal and live off of the dividends and interest. What do we do in an environment like this?

Q&A: No Double Deferral

I have had a longtime financial advisor who helped me with my 401k plan and my ROTH-IRA. I am now getting ready to retire and my advisor has suggested that I take my 401k and buy a variable annuity. What do you think?

Bond Indexing Efforts

It's not just pushing buttons to fire up a computer program. While not a difficult or expensive as operating an actively-managed fund, creating a bond index fund requires effort. Go behind the fund management scenes with Josh Barrickman, manger of Vanguard Total Bond Market Index fund.

Q&A: Taking Credit?

I'm a college student and a professor mentioned that all should get a credit card to start building up credit. Do you think it is worth applying for a credit card while in college and using it for small miscellaneous expenses? Is this truly beneficial to apply now or can it wait?

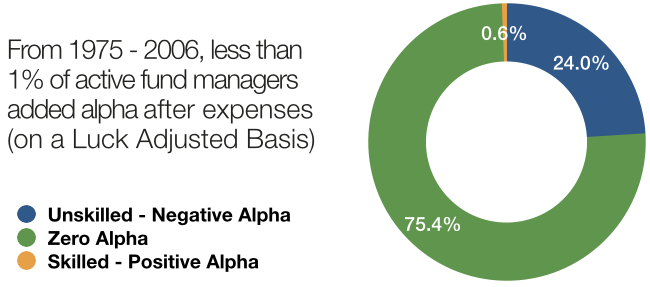

Active Failure

We strongly believe that active investing management (picking stocks, timing markets, etc.) cannot work. Study after study has found that the most likely explanation for the occasional success of some active managers is more easily attributed to luck than skill.

MLPs: High Yield, High Risk

Many investors blindly seeking high income have been steered into a complex hybrid security known as a master limited partnership or MLP. They are limited partnership units that trade on an exchange. They are regularly sold with the promise of annual yields of 5% to 7%.

Get a Strategy

To help you stay on course toward your loftiest dreams, we offer the compass of a solid investment strategy based on three key points. First, we have a strategy. Second, it’s a strategy based on reason and evidence guided by the durable science of capital markets. Third, it’s grounded in our fiduciary obligation to serve our clients’ highest financial interests.

Giving Real Thanks

On this Thanksgiving Eve, I want to thank all of you who take the time to read what we struggle each week to create for you. What would be the point of sharing what I consider to be incredibly important information if no one reads it. So, thanks for reading Real Investing Journal and sharing it with others.

Give a REAL Gift

Instead of driving around and braving the crowds, looking for some holiday gift that will soon be forgotten, how about giving one that really keeps giving and giving…

Un-bear-able Investing

Are you one of those people who always has an excuse to not invest. In 2008, as the market was falling, did you tell yourself you would wait until stocks looked better before investing. Then in 2009, were you waiting for it to drop just a bit more?

Why Bonds?

Why do people focus on what the future holds for bonds? In many cases, it is because they don’t look at the assets in their portfolios as parts of a whole. They obsess over each asset in their portfolio without consideration of how each asset in a well-constructed and well-diversified portfolio compliments the other assets in their portfolio.

Q&A: Starting Late

I just found out that one of my best friends has no retirement saved, has about $30k in debts and is still renting at the age of 50. I told him to start TODAY using our employer's 401k up to the max employer match then start paying those debts, and expect to work into his late 60s or early 70s.

The Right Advisor

Make sure you know your advisor before starting a business relationship. One of the most critical questions, “Are you required to act as a fiduciary?” It is estimated that 85% of financial advice professionals are not required to act in the best interests of their clients.

Investing Drivelism

Investors are starving for a source of real investing news, yet too few seem to recognize this journalistic deficiency. I hope that Real Investing Journal will gradually become one popular American voice for sound academically-vetted investing information.

Sport of Stock Betting

Sports betting and securities speculating are zero-sum games. For every winner, there must be a loser (someone who guesses right on new information and someone who guesses wrong on new information).

Q&A: How to Invest...?

Q: I will be retiring on December 30 2014 from the Post Office. I have a Thrift Savings Account with about $150,000.00. I would like to roll it over into an income account. Could you tell me where I should put it.

You Should Be Unhappy!

I guess I’ve been out of the stock brokerage business for far too long (I started my broker “recovery” in 1986). Until I read about them in Jason Zweig’s Wall Street Journal column, I had never heard of happiness letters.

Chilling Capital Gains

It's the time of year for apocalyptic screams surrounding the specter of taxes eating into your mutual fund and ETF returns. The real crazies come out of the woodwork, trying to confuse and scare you with what amounts to little more than just a lot of fake blood.