2014 Market Review from DFA

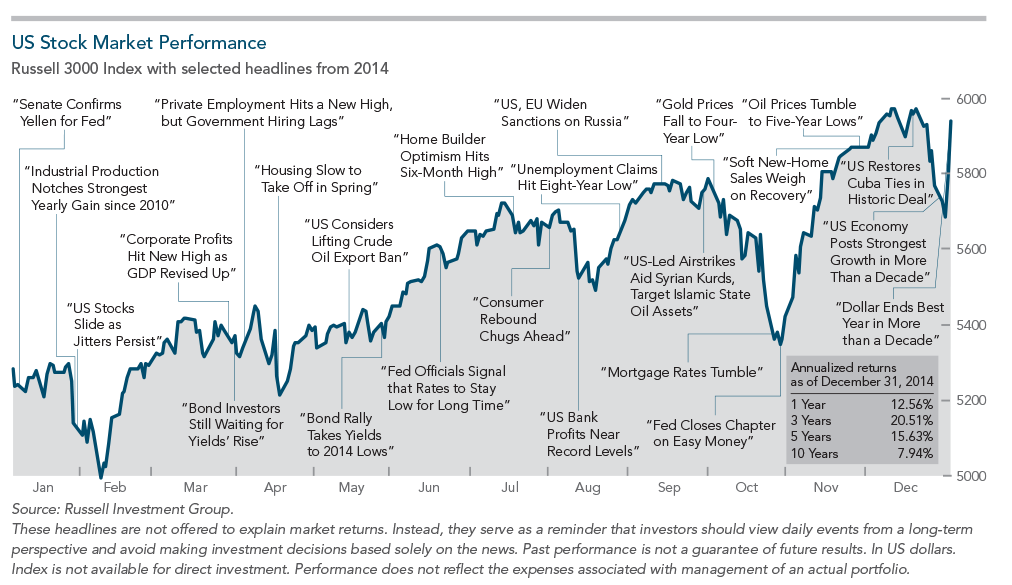

Despite a bumpy ride throughout 2014, the US economy gained pace while the US equity and fixed income markets outperformed most markets around the world. This performance came with higher market volatility in the US, a rallying dollar, slowing economies in Europe and Asia, and rising geopolitical tensions.

Frightful Fund Facts

Most of the investment industry is shocking bad at what claim to be able to do; make you money. The majority of mutual funds profess to possess stock selection and/or market timing skills, but the evidence doesn’t support their assertions

Q&A: Which to Fund First?

Should I stop my pretax 401k at my work, which is only breaking even for the past 2 years, and pay the payroll taxes and put into my Roth which I am self directing?

Investing Factors

Investing has evolved over the last fifty years. In the past, if you wanted to invest in the stock market you headed down to your local Merrill Lynch office and bought individual stocks through a broker.

2014: Patience Paid

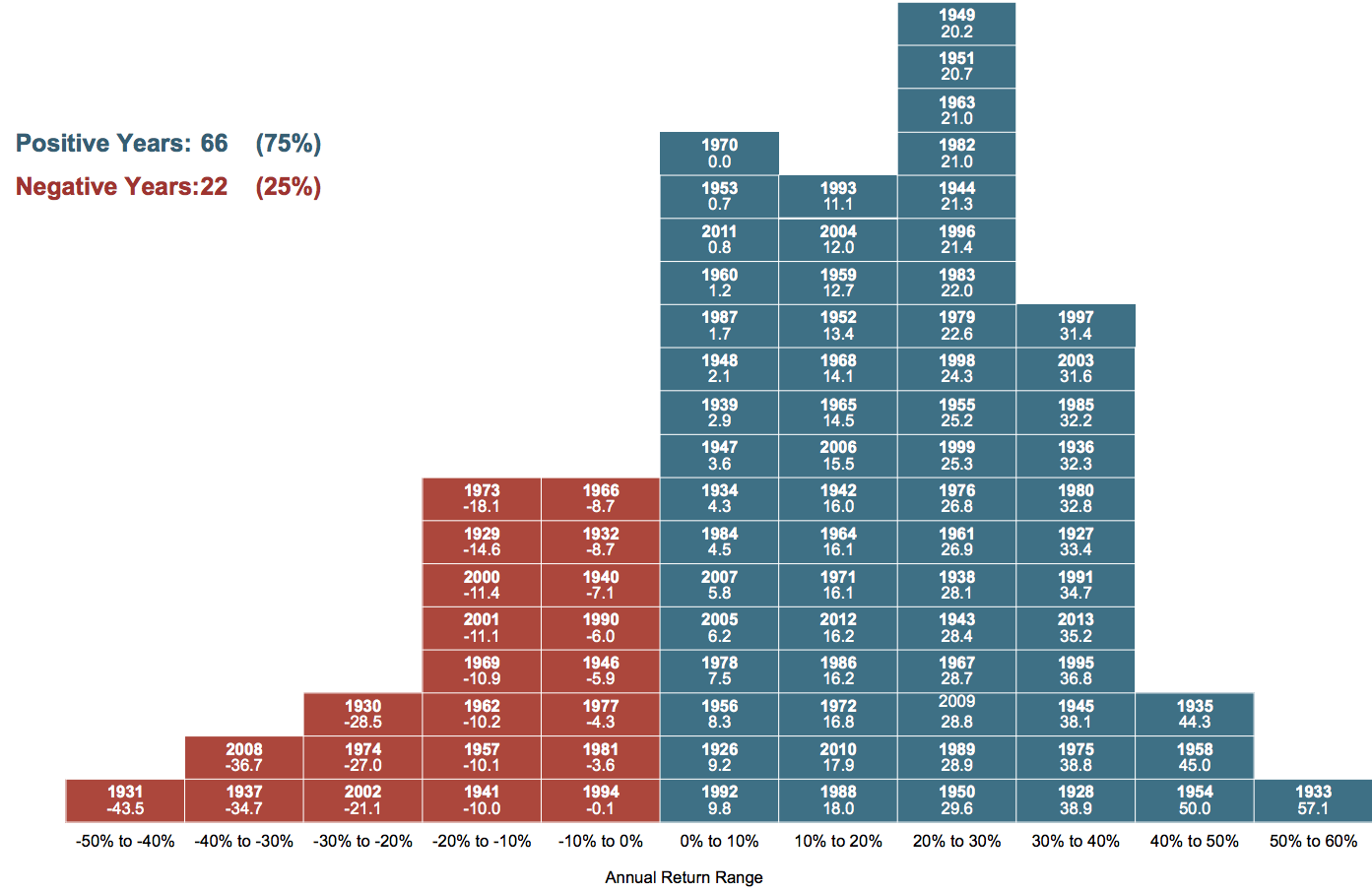

Achieving the market rate of return in 2014 required a level of patience and equanimity that eluded many investors—individuals and professionals alike. After five years of positive equity returns, many investors were easily persuaded that stocks were dangerously overvalued and overdue for a “correction.”

Rising Rates Dangerous?

For a few years now financial “experts” have been warning us that interest rates would rise as the U.S. economy improves. Like a stopped clock, eventually they will be right, we just don’t know when. But are rising interest rates the disaster that many fear?

Invest in Markets Not Stocks

Buying individual stocks is not a smart way for individuals to invest. While the rewards may be potentially grand, the risks are far higher than most realize.

Q&A: Hard to Get Started

I am looking for a financial planner to help me with getting on track for retirement. A friend recommended someone. He wants me to pay $1500 upfront to do some type of planning guide.

Most Must Lose

At any given moment, the stock market is basically a zero-sum game. This is a big part of the reason that active portfolio managers have such a difficult time outperforming their benchmarks.

Avoiding Timing Temptations

In light of all that did not happen in 2014, you cannot allow yourself to succumb to two common behavioral biases: Recency, or giving recent events more weight than they deserve; and Tracking-Error Regret, or abandoning your personalized diversified portfolio to chase last year’s (past tense) hot returns.

New Year's Predictions: Worthless to Wise

I see no reason to be reminded of all the sad and awful things that have happened and been more than adequately discussed. Let’s move on. Moving on doesn’t mean trying to figure out what will happen in the future. The past is over. The future is completely unknown.

Media Needs Active?

Making a living in the financial news industry is hard! Publishing even an online only publication requires revenue and the only firms with pockets deep enough to pay the needed fare for the money media tend to be those firms that provide some of the worst products and advice

Holiday Verses

I decided to try some a little different from the typical Christmas greeting. I hope it makes you smile. Thanks so much for reading our publication and we all wish you a most merry Christmas!

Q&A: Reinvested Dividends?

I thought I had a handle on my TSP (thrift savings plan) and how it works, now I'm not sure because of what my wife said is her understanding of her Vanguard account. She believes both of our accounts generate dividends that are automatically reinvested in our accounts in the form of shares which makes the accounts grow and compound.

Video: Income from Total Returns

Low bond yields have caused concern for those needing a stream of income from their investment portfolio. There is another, more holistic, option that was discussed by Vanguard's Chuck Riley in this short video taken from a live webinar.

Backdoor Roth

Roth IRAs are a great tool for building retirement assets, especially if you start contributing to them when you are young. Contributions to a Roth are not tax deductible, unlike traditional IRAs. The benefit of a Roth is that your money grows tax-free.

Finding the Help You Need

In a perfect world, everyone would be able to manage their own financial and investment life using no-load, low-fee mutual funds and ETFs. In fact, it’s a naive belief to which I clung for many years as a national financial talk show host. I may be slow, but eventually I get it. If we want to build wealth, most of us need professional help.

Active Portfolio Gambling

I don’t care how smart you are; you can’t predict the future. You can guess, and you might be right… or wrong. Some might call it betting a hunch. Except on Wall Street where it’s referred to as active portfolio management.

Q&A: Starting Young

This is a question about young investors. I would like to set up an account for my kids, age 20 and 18, to begin investing a fixed amount per month. In general, what do you recommend for young investors?

Don't Be Scared

Every so often, the financial markets test investors’ patience. Welcome to one of those times. Are falling oil prices good or bad? U.S. interest rates had nowhere to go but up. What happened? Stocks go up, stocks go down. What now?