Better Investing in 10 Steps

Here are 10 simple illustrated steps to creating a better investment portfolio based on decades of research by multiple Nobel Prize winners.

Inflation Investing

Have you wondered if the current low-inflation environment warrants a change in the way investors plan for potential future inflation? Two bond experts from Vanguard discuss planning for inflation.

Melt Down Under

The media occasionally locks in on a particular “hot” sector. In the late 1990s, it was technology. In the mid-2000s, it was mining. Writing headlines about fashionable sectors is one thing. Building investment strategies around them is another.

We All Do It

Investors are bombarded with information. Some of it is useful, most of it not so much. In the not so much category is most of the information provided by the financial media. In fact, this information is typically hazardous to your wealth.

The Perils of Deflation

Prices and wages can move in one of two directions; up or down. Rising prices are known as inflation. Falling prices mean deflation. American's has lived through an inflationary period for so long that few understand the dangers of deflation.

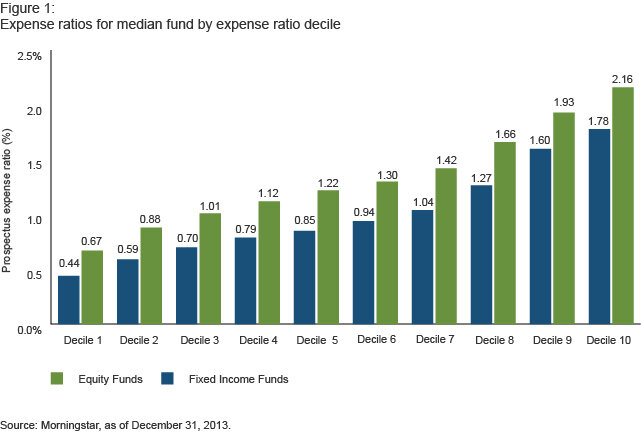

The Case for Index Investing

Since its beginnings in the early 1970s, indexing as an investment strategy in the United States has grown rapidly and has performed favorably in relation to actively managed investment strategies. Indexing has many recognized advantages: low costs, broad diversification, minimal cash drag, and—for taxable investors—the potential for tax-efficiency.

A New Path to America's Ears

Fact: Most of the investing shows on commercial radio stations are paid infomercials. Getting a truly helpful show or real investing features on most radio stations requires huge outlays of cash.

They Don't Mean It

What investment brokerage firms say and what they mean are apparently polar opposites. They want you to believe that they are acting in you best interests with catchy slogans, but when complaints are filed their tune changes.

Recipe for a Better Portfolio

In the popular TV program MasterChef, contestants face a series of cooking challenges. From low quality ingredients to inadequate preparation and poor implementation, so many things can, and do, go wrong. It’s a bit like investing.

Wisdom Smorgasbord

I wouldn’t recommend most firm’s shareholder letters, but Warren Buffett’s letters to Berkshire Hathaway shareholders are unlike any others. They are filled with gems of wisdom that anyone can use to improve the way they invest, manage money, and just live a better life.

Having THE Money Talk

Many families have an unspoken taboo in regards to talking about money. Should you have a conversation with your heirs about your finances and how should you go about it.

Q&A: Best Bond Home

I know I need bond funds but, which is it best place to have bond funds? In IRA'S, Roth, 401 or in my regular taxable account? Which is the worst place to have bond funds?

Lower Future Returns?

What kind of returns should investors reasonably expect from their portfolio in the current environment? Vanguard's Chief Investment Officer, Tim Buckley and Chief Executive Officer, Tim McNabb discuss the possibilities for the future in this recent interview.

Benefits of Bonds

Is it inevitable that interest rates are going up? Someday, it’s likely that they will but will rates rise in the next year or two? There is no way to know. Japan is recent example of what has happened to 10-year government bond rates over a fairly long period.

Q&A: Seeking a Stock

I'm trying to find the company that manufactures touch screens for Apple, hp and many others. Supposedly there is one company that produces more screen than any other company. Do you know the company? I understand their stock out performs the norms. Thank, mark

Dear Broker...

Breaking up is hard. It's one of the biggest reasons clients continue relationships with financial advisors even after learning that the advice provided may not have been in their best interests. In many cases, we have a personal connection we our brokers or advisors and don't want to hurt that relationship.

Investing "Fails"

Pop culture and investing rarely cross paths. After all, pop culture is hip, exciting, and flashy. Conversely, we’ve seen that successful investing is generally anything but. Nevertheless, the last decade or so has seen the rise of an internet meme that may be applicable to the investing world—“FAIL.”

Q&A: Stock Screens

Some time ago, I became a life member of the AAII (American Association of Individual Investors). The organization provides many different "stock screens" that encourage members to develop small stock portfolios that usually seem to beat the S&P 500 over time.

Grow. Right. Here.

Everyone deserves great investing advice but until now your portfolio needed to be $250,000 or more. Otherwise, you were either forced to work with commissioned stockbrokers and insurance agents or you were relegated to going it alone with a confusing array of no-load funds (many of which cost more than fee-only advisors).

Risk vs. Uncertainty

One of the most important concepts that an investor needs to understand is the difference between risk and uncertainty. “Risk is present when future events occur with measurable probability. Uncertainty is present when the likelihood of future events is indefinite or incalculable.”