Weather vs. Climate

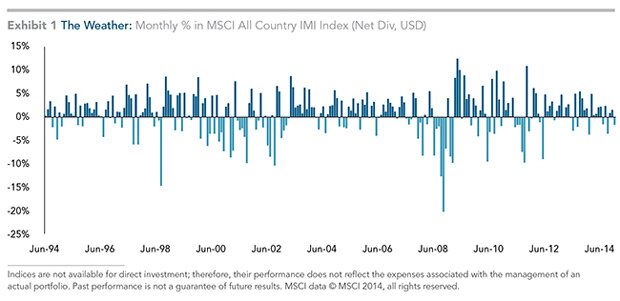

Notice how TV news bulletins put finance next to the weather report? In each, talking heads point at charts and intone about intraday events that are quickly forgotten. Meanwhile, the long-term wealth building story gets overlooked.

Can Best Interests Be Bad?

If you have a retirement plan at work, would you prefer that your 401(k) or 403(b) plan advisors be allowed to sell you expensive products that are probably suitable for you or that they be required to offer you the best possible investment products at the lowest possible costs?

Q&A: Finding an Advisor

My question, being from the New York city area, (there are hundreds to choose from), I was wondering if you know of any CPAs and CFPs that you recommend or could refer.

Nearsighted Investing

Myopia is a common condition for many people. If left untreated, this condition can be dangerous for the sufferer and others. Fortunately for those of us who have this condition, corrective lenses or laser surgery can remedy it. Myopic thinking, on the other hand, is common in humans and much more difficult to “cure”.

Buy What You Know?

When Peter Lynch managed Fidelity Magellan fund he inspired investors to “buy what you know.” Years later he changed his tune advising that the investing “would be better off in an index fund.”

Zero Sum Game?

Real investing is not a “zero-sum” game, trading is. When trading securities for every buyer, there is a seller. For every winner, there is a loser.

Big Returns, No Risk?

Here’s the pitch: A special type of life insurance policy may be better than a Roth IRA. Tax-free growth! Stock market returns! No risk! Who wouldn't want that?

Can't Catch It

Chasing after the latest hot segment of the market or mutual fund is a lot like trying to drive a car forward while only looking at the rearview mirror. What has already passed does not tell you what lies ahead.

Advisor Questionnaire

Choosing someone to help manage your investments is tough. Most of those who hold themselves out as “financial advisors,” are nothing more than high commission salespeople. As soon as they close the sale with you, they are off to the next prospect.

Q&A: Zero-Sum Investing?

Many investors say that investing is a "zero-sum" game and that those who allocate their portfolios in index mutual funds end up with the upper hand. How does help index investors?

Any Hedge Edge?

How can U.S. investors reduce currency risk? By hedging the value of the international currencies against the dollar. The tools to do this are beyond the scope of this discussion but does currency hedging pay off for investors?

Q&A: LTC Substitute

For those who can't qualify for traditional Long Term Care (LTC) Insurance due to pre-existing health condition, what strategy would you recommend to fund LTC, assuming that self-insurance is not realistic?

REIT Reality

One of the hottest investment classes last year was real estate. Not individual homes, but real estate investment trusts, known by their acronym; REITs. While the global stock market returned just over 3% in 2014, Vanguard's REIT Index fund made over 30%.

Fiduciary Pursuit

In the medical profession, physicians practice according to a familiar standard: “First do no harm.” There should be a similar level of commitment for anyone who wants to advise you about your financial well-being, right? Unfortunately, wrong.

Q&A: Add International Bonds?

Is there any academic evidence that holding some international bonds (in a high quality international bond fund) would significantly increase return or decrease volatility in that fraction of one's investment portfolio dedicated to bonds?

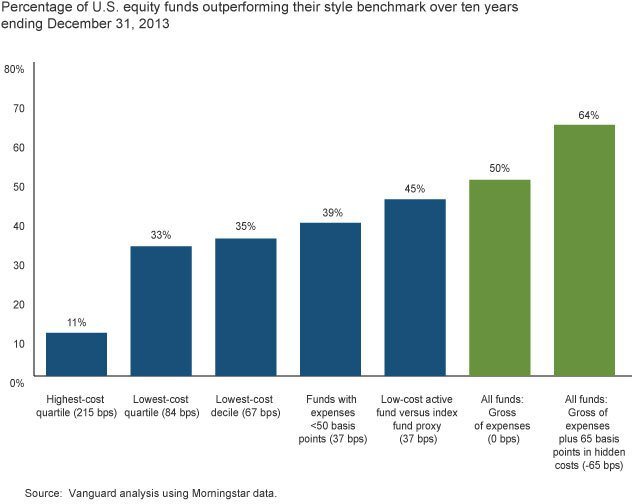

Be Average

No one wants to be average. Just think about the fictional Lake Wobegone, where “all the women are strong, all the men are good-looking, and all the children are above average.” The mathematics of whether more than 50% of anything can be above average aside (impossible), this quote has relevance in the investing derby.

FINRA's Naughty List

Every year the Financial Industry Regulatory Authority publishes its Regulatory and Exam Priorities Letter or as I like to call it, "Investing's Naughty List." These are investments that FINRA believes are likely to be badly sold and I believe are best avoided.

Q&A: Stay in Bonds?

My work place 403b plan has only 3 bond fund options: Vanguard Total Bond Market Index (VBTLX), Prudential Total Return Bond Z (PDBZX) and Metropolitan West Total Return Bond I (MWTIX). I would like to keep bonds in my 403b because of tax efficiency. Is this a wise thing to do given the options?

The Factor Difference

Today’s investors can take advantage of many advances in academic finance; including "factor" investing. Factor investing involves overweighting (relative to the overall stock market) small cap and value stocks. In 1992, Professors Eugene Fama and Kenneth French documented the historical return premiums (over the market return premium) of small cap and value stocks.