Your Q's, Our A's

For those who unable to or are uncomfortable calling our talk show, there is any easy way to get your real investing questions answered. Send them to RIJ.

The Mutual Fund Landscape - Part Three

If competition drives prices to fair value, one might wonder why underperformance is so common. A major factor is mutual fund costs. Costs reduce an investor’s net return and represent a hurdle for a fund. To outperform, a fund must add enough value to exceed its costs.

ELPs: Expensive Local Peddlers?

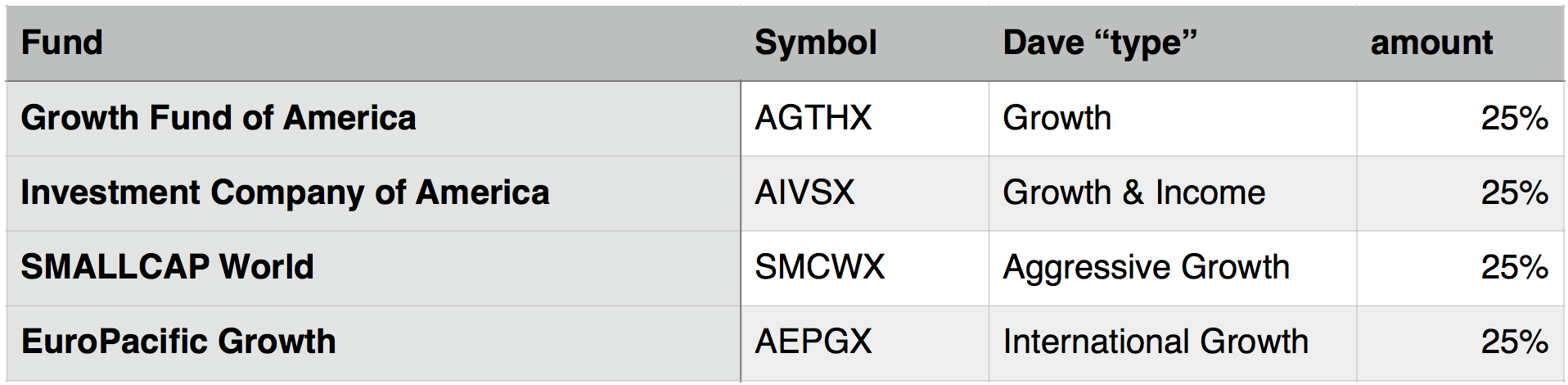

One of the hazards of being a well-paid, highly-opinionated, public figure is the fact that your pronouncements and claims will (and should) be subject to scrutiny (mine certainly have). In the financial media, there are few more well known than nationally-syndicated radio host, Dave Ramsey and some of his advice warrants closer examination.

Timeless Tax Tips - Part Two

In Part I of our series on Tax-Wise Investing, “You and Your Investments,” we explored how to engage in year-round tax-wise investing by adopting your own best practices as well as by favoring fund managers who are likewise keeping a tax-efficient eye on their offerings. There are two other important areas to tend to as part of your due diligence.

The Mutual Fund Landscape - Part Two

The competitive landscape makes the search for future winners a formidable challenge. Confronted with so many fund choices, some investors may resort to using track records as a guide to selecting funds, reasoning that a manager’s past outperformance is likely to continue in the future.

When the Best Isn't

For three years running, Lipper has named TIAA-CREF funds as the best fund family in America. If they’re the best, you would expect they would have bested those dull, boring Vanguard index funds or Dimensional Fund’s (DFA) non-predictive asset class funds.

Seven Roles of an Advisor

What is a financial advisor for? One view is that advisors have unique insights into market direction that give their clients an advantage. But of the many roles a professional advisor should play, soothsayer is not one of them.

Interest Rate "Liftoff"

Excerpts from an interview with Vanguard's Global Chief Economist Joe Davis and Senior Economist Roger Aliaga-Díaz about their projections for the U.S. interest rate "liftoff" and whether or not the market may have priced in rising rates.

Timeless Tax Tips - Part One

While “tax season” may imply that there is an optimal time to think about your income taxes, the best way to minimize your annual “pay-triotic duty” is to engage in year-round tax-wise investing, with ongoing best practices.

Value of Advice

Can ongoing personalized investing advice actually cost less and potentially make you more? Thanks to technology, it now can, even if you have a small portfolio

The Mutual Fund Landscape - Part One

The U.S. mutual fund industry comprises a large universe of markets around the world. These funds reflect different philosophies and approaches. In this multi-part series, find out the industry has performed and what you should think about when selecting funds.

Factoring in Growth

What are some of the risk “factors” that investment researchers have discovered to have effectively increased returns in the past?

Financial Roadmap

Summer is not far away and many people are planning their annual vacations. In planning a trip it helps to know where you are starting from, what you’ll spend for the trip, and having some extra money to handle unexpected events along the way.

Real vs. Robo

Will robo-advisors free us from money-making decisions that a well-programmed computer can now do just as well, or are they the financial equivalent of an un-manned Terminator? As is so often the case with powerful possibilities, the answer depends on how you incorporate the auto-action into your personalized investing.

Keys to Investing Success

Core investing principles are united by a common theme: Focus on the things within your control. By attending to the things you and your advisor can influence, rather than uncontrollable factors such as the markets, the economy, or the performance of an individual security or strategy, you give yourself the best opportunity for investing success.

Q&A: Savings Bonds in Portfolio

When figuring out one's stock/bond mix should I count my savings bonds in the bond "bucket" or just emergency cash (to borrow a term from another radio guy)? I have been buying a low denomination of savings bonds weekly for the past few years, but I am only 43 and don't want to have too much money in bonds.

Radio Shows: Verify Before You Trust

The radio airwaves are filled with financial and investing advice shows. Should you trust what they tell you. In most cases, the answer is probably not. Before you trust someone, verify!

How Much? Really?

The arguments rage on. How much will you need to retire comfortably? Some say more than you might think. Others claim that it will cost you less to live in retirement. Two articles at Marketwatch argued these two perspectives.

Way Down, Way Up, Rebalance!

Since the U.S. stock market hit bottom on March 9, 2009, during the Great Financial Crisis, the S&P 500 Index had risen a stunning 248% as of the first quarter of this year. In little more than six years, the present bull market has broken several records and surpassed history’s larger bull markets.

Modern Money Alchemy

Be wary of Wall Street’s latest attempts to convince you that you can have it all: high returns, principal safety, and immediate liquidity. Real investing involves trading one important feature for another. In other words, you can’t have everything you want.