Investing for Retirement Income III

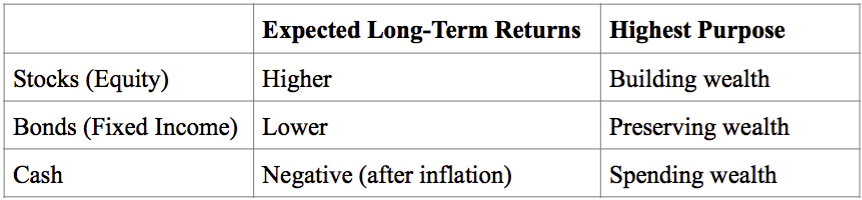

As we discussed in the first two parts of this three-part series, we do not recommend turning to dividend-yielding stocks or high-yield (“junk”) bonds to buttress your retirement income, even in low-yield environments. So what do we recommend? Now we’ll answer that question by describing total-return investing.

Don’t Get It?

Here is a hard lesson that seems to be consistently ignored and yet gets repeated over and over again: If you don’t understand an investment, don’t invest in it. The pitfalls of these glowingly pitched products may not be readily apparent, but they often rear their ugly heads at some unexpected point in the future with disastrous results for investors.

April (and May…) Fool’s

If, on April 1st, someone offered you an investment that promised the higher returns of the stock market with no risk of loss, you would suspect a prank. I’d hope that if you heard this on any other day of the year you would would immediately think “scam.” Yet, every day of the year some stockbroker or insurance agent is making this outrageous claim about a product referred to as some variation on the term “indexed annuity” or “indexed life.”

Investing for Retirement Income II

In Part I of our three-part series on investing for retirement income in low-rate environments, we explained why we don’t advise bulking up on dividend-yielding stocks as a reliable way to generate retirement cash flow. Like the Three Little Pigs’ straw house, dividend-yielding stocks can disappoint you by exhibiting inherent risks just when you most need dependability instead. Another popular tactic is to move your retirement reserves into high-yield, low-quality bonds. Let’s explain why we don’t typically recommend this approach either.

Why Diversify?

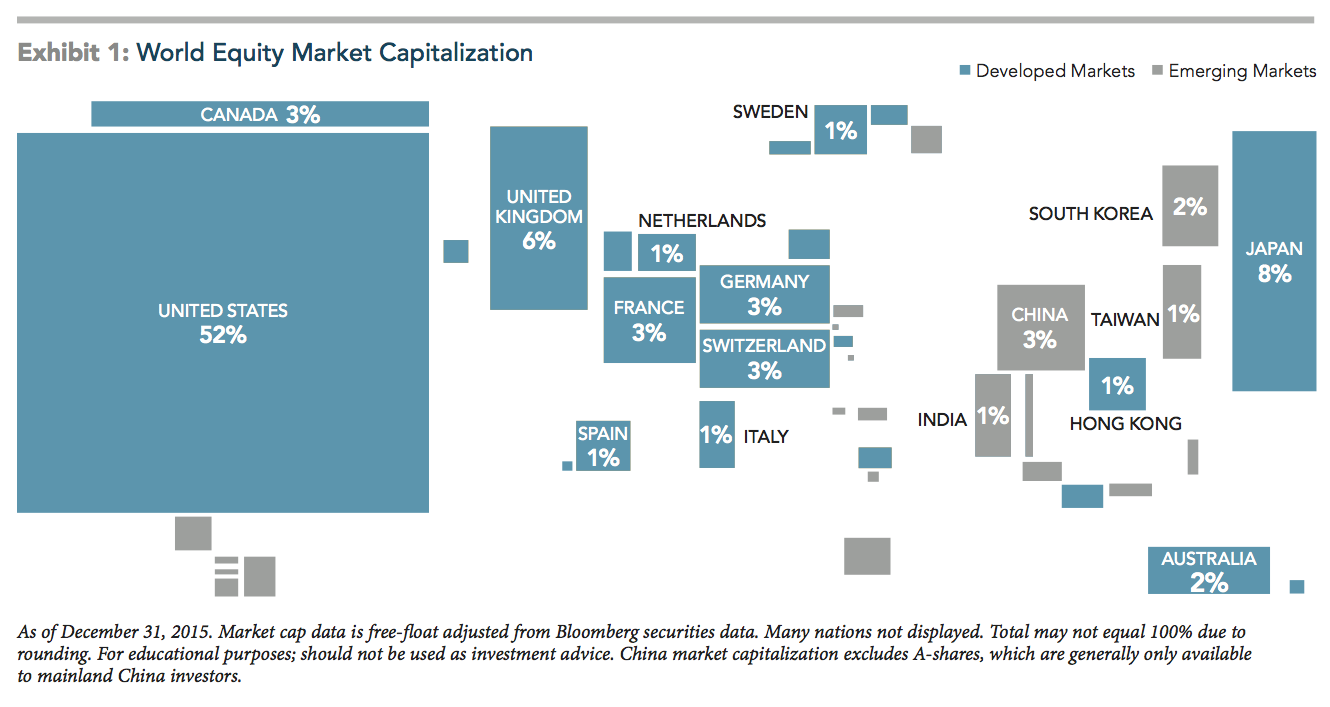

Equity markets have experienced a sharp decline to start 2016, leading some investors to reevaluate their asset allocation. As US stocks have outperformed developed international and emerging markets stocks over the last few years, some investors might consider reevaluating the benefits of investing outside the US.

Investing for Retirement Income I

We understand why bulking up on dividend-yielding stocks can seem like a tempting way to enhance your retirement income, especially when interest rates are low. You buy into select stocks that have been spinning off dependable dividends at prescribed times. The dividend payments appear to leave your principal intact, while promising better income than a low-yielding short-term government bond has to offer.

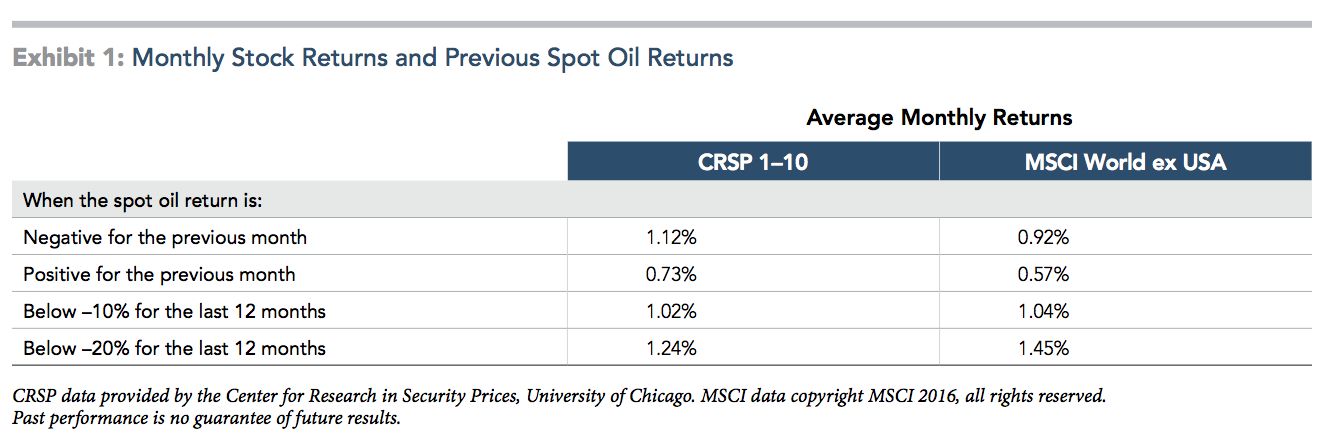

Oil & Markets

In the past there has been little correlation between oil prices and the value US stocks, Lately, stocks and oil prices have been moving in a more similar fashion. Is it likely that oil and stock prices will correlate more closely in the future? The analysts at Dimensional Funds explore the possibilities.

Value Premium Vanishing?

Value stocks underperformed growth stocks by a material margin in the US last year. However, the magnitude and duration of the recent negative value premium are not unprecedented. This column reviews a previous period when challenging performance caused many to question the benefits of value investing. The subsequent results serve as a reminder about the importance of discipline.

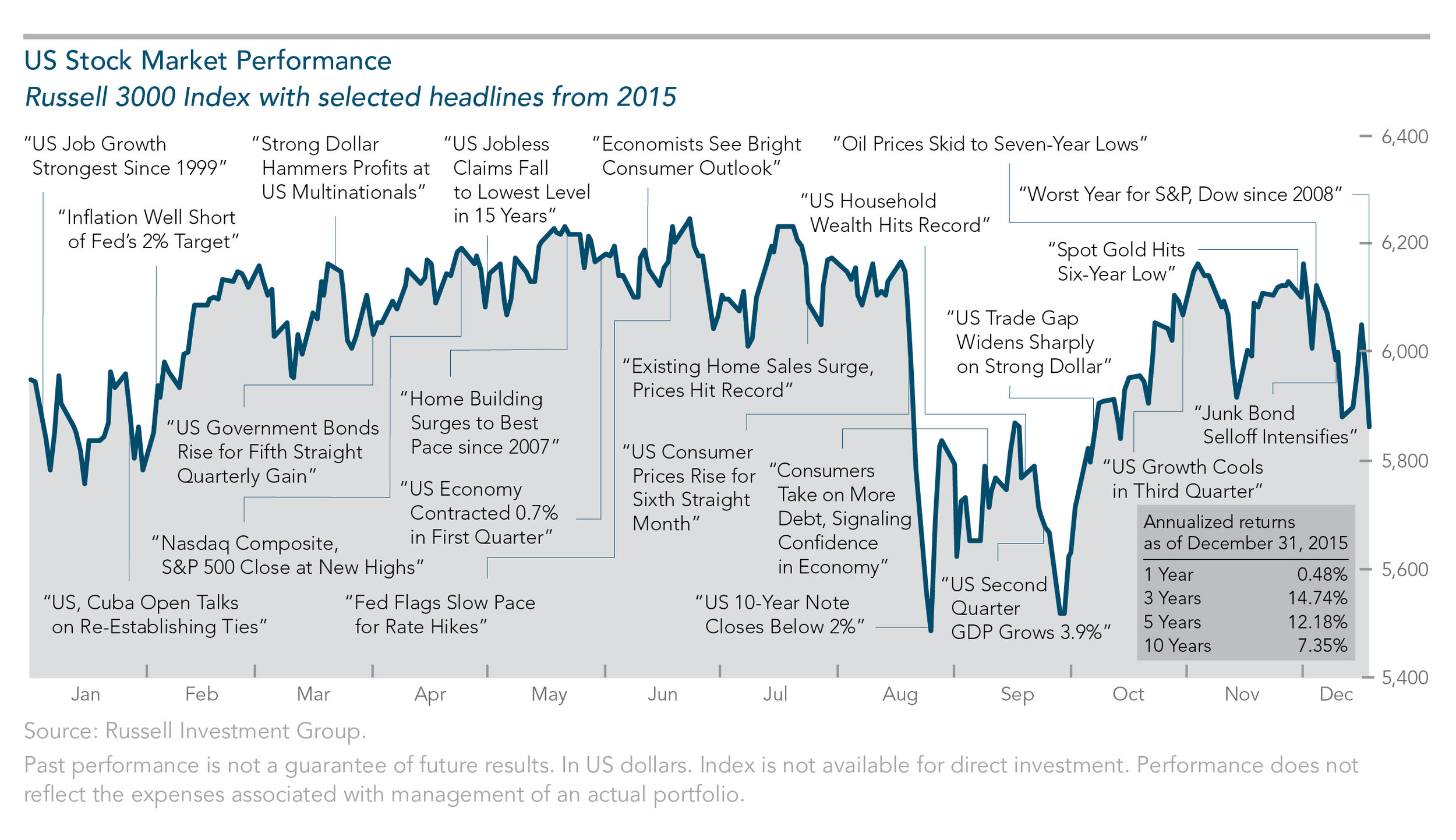

Review of 2015

The US economy and broad market showed modest gains during the year, although investor discipline was tested by news of a global economic slowdown, rising market volatility in China and emerging markets, falling oil and commodities prices, and higher US interest rates.

Another Medium

I am ready to announce my new Medium publication, "Real Investing." Here I will post short pieces based on the daily radio features I create for KOMO Newsradio is Seattle.

Q&A: More Into Simple?

I make about 60K per year. My boss puts in 15% of my annual income in a Simple IRA (all at once). I've never contributed any of my own money, but would like to start doing that if possible. Is there a maximum amount that can go into a Simple IRA each year?

News We Don't Need

One academic study appears to confirm the view that the apparent preponderance of bad news is as much due to demand as to supply, with participants more likely to select negative content regardless of their stated preferences for upbeat news.

Finding the Finest Funds

When introducing evidence-based investing, we like to begin by explaining why we feel it’s the right strategy for those who are seeking to build or preserve their wealth in wild and woolly markets. Of course sensible strategy is best followed by practical implementation, so it’s also worth describing how we select the funds we typically employ.

Fathoming Fed Fears

Understand that there is an intricate interplay between developed nations’ monetary policies, global interest rates and the markets in general – and that these components are nowhere near one in the same. Anyone who claims to know exactly what will happen in one arena when we pull a lever in another had best be able to present a functioning crystal ball if he or she is to be believed.

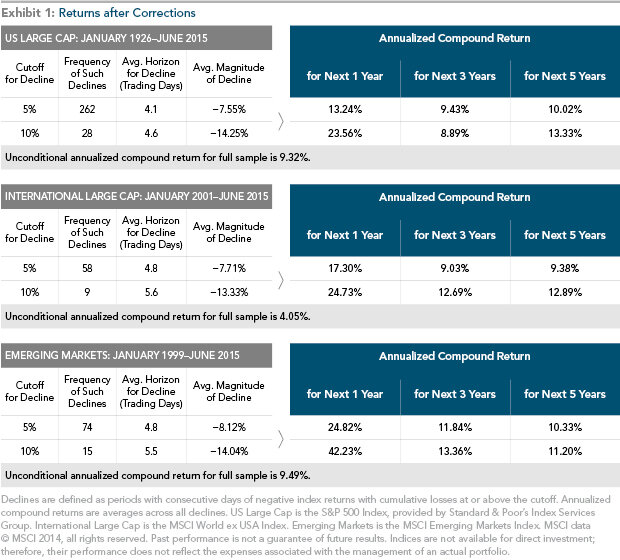

Correction Direction?

Market timing is a seductive strategy. If we could sell stocks prior to a substantial decline and hold cash instead, our long-run returns could be exponentially higher. But successful market timing is a two-step process: determining when to sell stocks and when to buy them back.

Banish Bad Behavior

Have you ever made yourself suffer through a bad movie because, having paid for the ticket, you felt you had to get your money’s worth? Some people treat investment the same way.

Ignorance is Bliss

There’s a joke circulating online that, if you commit a crime and you need to hide the evidence, you can stash it on page two of a Google search. At least 90 percent of the time, nobody looks there. In fact, about half of our clicks are bestowed on the first two hits we see.

Income Investing Insecurity

Anyone who is keeping even a casual eye on financial headlines these days is aware that fixed income returns have been a moving target for a while now – at home and abroad. The general consensus is that rates will rise eventually.

Control Costs

Why do investors spend more than they need to on their investments? While spending less to earn more seems obvious, the costs themselves aren’t nearly as apparent.

Patience, Perspective, & Phoenix

The recent downturn for stock prices requires some reiteration of our basic investing principles of patience and perspective. All of our latest articles tackle this important theme. Plus, big news in Phoenix!