The Patience Principle

Global markets are providing investors a rough ride at the moment, as the focus turns to China’s economic outlook. But while falling markets can be worrisome, maintaining a longer term perspective makes the volatility easier to handle.

Perspective and Patience

I read a quip in the local paper over the weekend: The stock market takes the stairs up but the elevator down. As I felt the elevator begin its descent this week, my stomach lurched a bit, but I kept coming back to the fact that good investing requires discipline and a bit of courage.

Q&A: 401: Roth or Regular

How do I determine if a Roth 401k is right for me over a standard 401k? I also have a standard Roth IRA. My employer matches 50 percent in my 401k.

Q&A: Government or Tax-Free

You frequently mention putting the bond fraction of a diversified portfolio in short and intermediate-term bond funds. My question is: if one needs to keep some of those bonds in a taxable account, are tax-free (municipal) bond funds a reasonable alternative to treasuries?

Q&A: A Need for Risk

I'm 62 and one of those who woke up to the need for retirement income late. I am way behind and am willing to take more risk than I probably should to try to catch up but I have no idea where to put the money to its best advantage.

Risks and Temptations

There is no getting around the fact that the market does not deliver rewarding returns without periodically punishing us with realized risks. That is why it’s so challenging for most investors to “be there,” consistently capturing available returns by remaining invested over time. It’s also why it’s vital to avoid taking on more risk than you must in pursuit of your personal goals.

Bad Not So Bad

Are you are wondering whether you should adjust your investments in light of current events? This is a good time for some context on why withstanding today’s bad market news can actually translate into good news for you and your investments, at least in the long run.

Woefully Misinformed

Most American investors are woefully uninformed. The past three years of Bankrate.com surveys show that Americans favorite long term remains real estate, despite the fact that, over the last decade, you could hardly have done worse.

Stopped Clocks Win

Most people claim they don’t believe in psychics, yet millions of people look to market forecasting “experts” for investing advice. What makes one predictor of future events more credible than the other?

Investing Between the Lines

When making investment decisions, most people likewise assume that the most eye-catching ink matters the most: an alarming economic forecast, an exciting Initial Public Offering, hot trading tips. But there’s a catch. This evident assumption does not hold up under evidence-based scrutiny.

Grecian Concern?

In recent weeks, the world’s markets and media financial pages have focused intensely on the standoff between debt-laden Greece and its international lenders over the conditions of any further bailout. Is this Grecian financial crisis a cause for serious concern?

Preponderance of Evidence

There are any number of investment philosophies. You can follow squiggly lines of a chart. You can pore over financial reports and balance sheets trying to find a piece of valuable data that no one else has discovered in their painstaking research. Or, you can stop looking for a bag of magic beans and rely instead on decades of hard work by a small army of academics. We call it "evidence-based investing.?

Crisis Mode?

In the wake of this nation suspending payments on its debt the Standard and Poors 500 lost about 10% of its value in just two weeks. Investors worldwide fear the worst what should you have done?

Q&A: Whither Rates?

I'm 60 years old with a portfolio of 65% stocks and 35% bonds.( $400,000 in intermediate term bonds.) My Fidelity broker is anticipating an interest rate hike in September. He wants me to sell $150,000 of the bonds and move to cash. Should I make a move?

Lowering Expectations

Publishing a weekly newsletter is a massive undertaking for a decent sized staff. For a single person, it is a monumental task. While Real Investing Journal is a labor of love, I can’t keep up this pace and still create all of the other educational material I have both committed to and hope to undertake in the future.

Q&A: Beyond Great Expectations

Where can i find competent 20% yielders or higher? I am a dividend investor looking for monthly income.

Rough Road Investing

Owners of all-purpose motor vehicles often appreciate their cars most when they leave smooth city freeways for rough gravel country roads. In investments, highly diversified portfolios can provide similar reassurance.

Q&A: Prototype Portfolios

Do you have a model portfolios? I am 80 and need advice on investing wisely about

$400,000. I am presently in Vanguard Funds.

The Mutual Fund Landscape - Conclusion

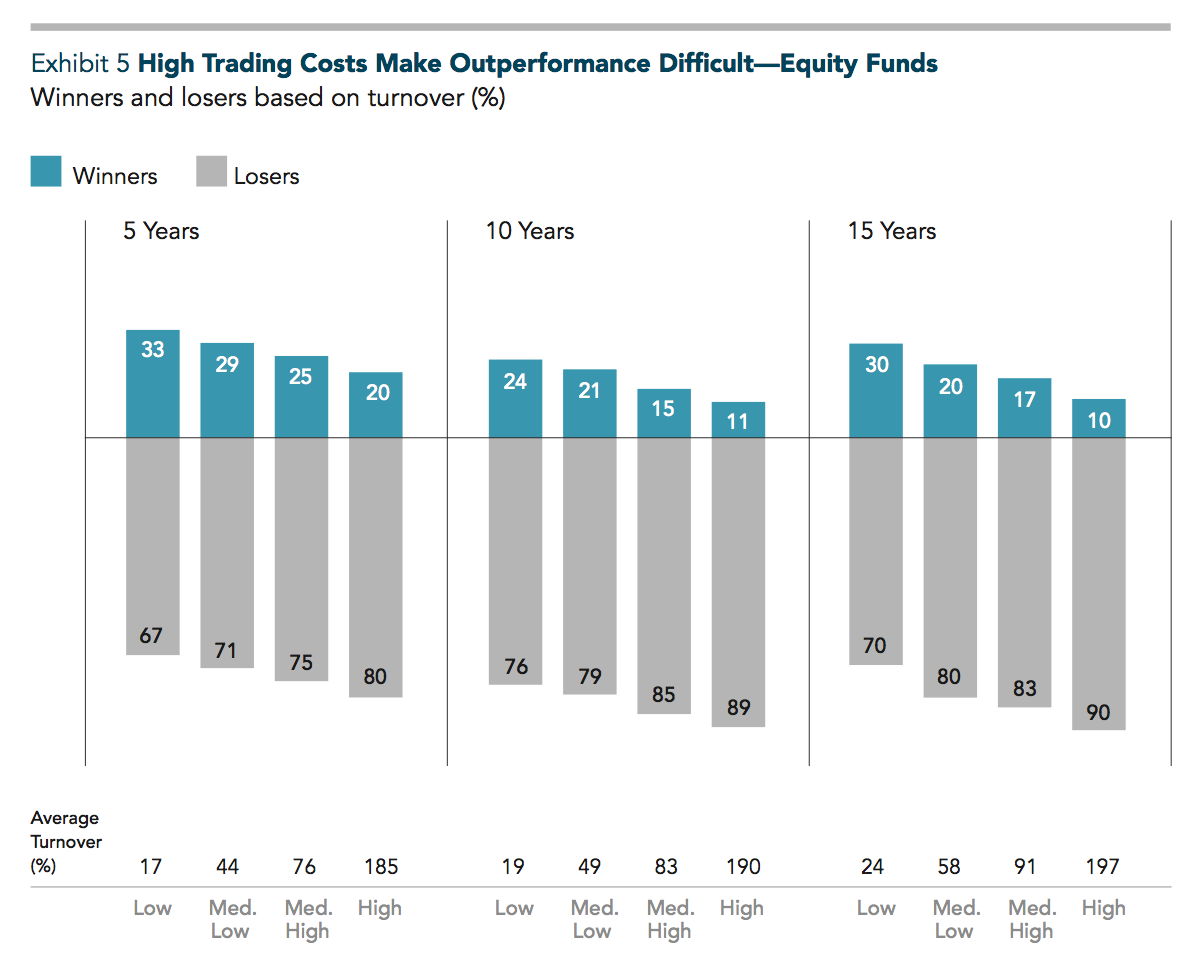

There are other activities can add substantially to a mutual fund’s overall cost burden. Equity trading costs, such as brokerage fees, bid-ask spreads,1 and price impact, can be just as large as a fund’s expense ratio. Trading costs are difficult to observe and measure, but they impact a fund’s return nonetheless—and the higher these costs, the higher the outperformance hurdle.

Be Prepared

On September 29, 2008, less than seven years ago, the Dow Jones 30 Industrials (nowhere near the best index to use) suffered its biggest one-day drop in 20 years. Less than two weeks later, London’s Daily Telegraph proclaimed that the financial crisis was “the worst the world has ever faced.”